Why a solid strategy do not only bring great profits but also calm and composure to your trading

Hello, trader,

welcome to the third day of our exciting trading challenge. The last two days were already packed with important information and initial insights into the craft of trend drawing and technical analysis in general. Today, we are taking it a step further by looking at one of the most successful strategies – trend following.

In trading, a solid strategy is essential. This is because trading is heavily dependent on the law of probability. However, implementing this simple assumption can be challenging in practice. Many traders tend to give in to impulsive and emotional decisions instead of sticking to a clearly defined set of rules.

For instance, they might move the stop loss a bit lower because “the market needs some room to breathe.” Instead of risking 1%, they might increase it to 5% because after five losing trades, this one must work. Quickly, they find themselves in a highly unpleasant, if not extremely stressful, situation from a psychological perspective. At the same time, their hard-earned capital begins to melt away.

This can lead to hasty actions often accompanied by mistakes and losses.

Every trading strategy is linked to a specific probability of winning. To maintain this probability consistently, it is necessary to trade every signal that meets your rule set’s criteria. Changing the rules or sporadically using other trading approaches can significantly worsen the expected outcome.

Furthermore, it is crucial to practice the implementation of the chosen strategy intensively to analyze the markets quickly and confidently.

A proven trading strategy helps to control emotions such as fear or greed and provides the stability needed in the trading process to minimize errors.

In short, applying a solid trading strategy is a key building block for success in trading. For traders who want to stay in the market long-term, it is especially advisable at the beginning of their careers to rely on a solid, tested strategy.

I know there are many strategies that are highly praised because they supposedly promise spectacular and groundbreaking profits. These strategies do exist, no question. But usually, these strategies are so complicated that they do not lead you to success. That is certainly not your goal.

What is Trend Following?

If you’ve often wondered why trading seems like a clear, straightforward path to success for some, while for others, it resembles a labyrinth, let me open your eyes.

The key to success in trading does not lie in secret formulas or constantly changing strategies but in the consistent application of a logical, proven method: trend following.

All markets worldwide, whether stocks, forex, or commodities, follow trends that repeatedly show up. These trends are not a product of chance but follow an inner logic that drives the market.

Of course, we private traders often tend to think only of ourselves and other private traders, but unfortunately, we are not the drivers of the markets. Only the largest institutions or hedge funds have the power to move the market in a desired direction.

This is where trend following comes into play – it utilizes the fact that markets follow certain patterns.

Trend following strategies aim to profit from the tendency of markets by consistently applying rule-based trading systems to many different markets.

Many of the world’s most successful hedge funds and traders have been using trend-following strategies for decades.

Here are the essential truths about trend following that I am sharing with you now:

To this day, the strategy of trend following is based on a small network of relatively unknown traders who, apart from occasional misguided articles, are almost ignored by the mainstream press – and this has not changed for decades.

Successful trading is not based on the ability to predict the future, but rather on the ability to recognize and react to what is currently happening in the markets.

No one has a crystal ball that reveals the future. The markets are inherently unpredictable, and events can occur unexpectedly and reverse price trends. By accepting that the future is not predictable, you free yourself from the burden of making perfect decisions. Instead, you gain the flexibility to react to what the market shows you.

The key lies in detaching yourself from speculation about what might or should be and focusing on what is actually happening. This approach gives you a significant advantage because you base your trading decisions on real data and trends, not on guesses or hopes.

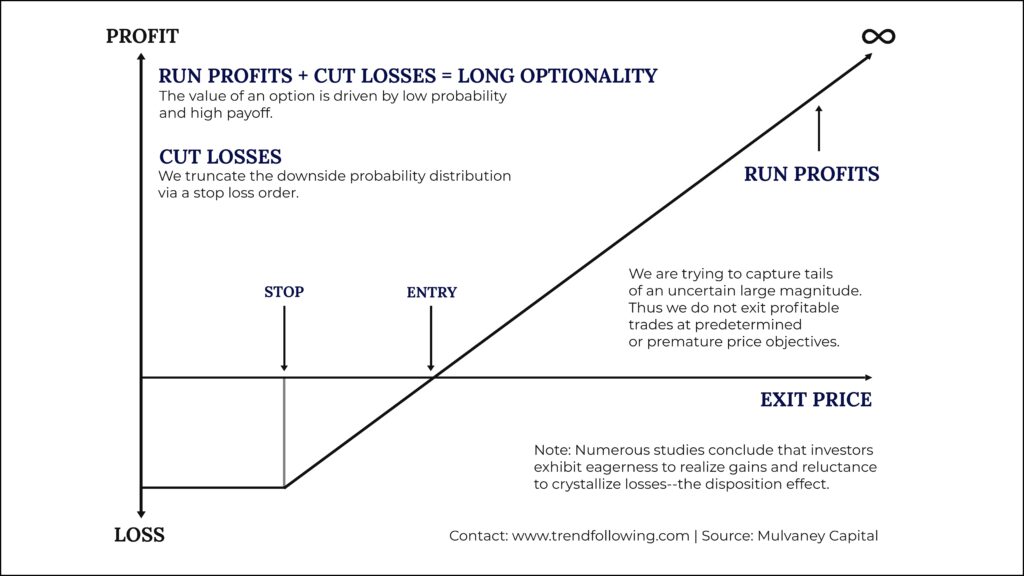

Another central aspect of trend following is accepting the inherent risks of the market. Prices can rise, fall, or move sideways. Each of these movements offers both opportunities and risks. Losses are an inevitable part of trading, but through disciplined application of trend-following strategies, these risks can be contained and controlled.

Ultimately, trend following reminds us that trading is only about the here and now. The past has already happened, and the future is yet to be written. The current trend provides the best guidance for trading decisions. By following the trend instead of trading against it, you position yourself to profit from the market’s movements, no matter which direction they go.

These principles of trend following are not just strategies for financial success but also life lessons. They teach us to deal with uncertainty, remain flexible, and accept and utilize the reality of the moment. By internalizing and applying these essential truths, you lay the foundation for long-term success in trading.

To this day, the strategy of trend following is based on a small network of relatively unknown traders who, apart from occasional misguided articles, are almost ignored by the mainstream press – and this has not changed for decades.

Successful trading is not based on the ability to predict the future but rather on the ability to recognize and react to what is currently happening in the markets.

No one has a crystal ball that reveals the future. The markets are inherently unpredictable, and events can occur unexpectedly and reverse price trends. By accepting that the future is not predictable, you free yourself from the burden of making perfect decisions. Instead, you gain the flexibility to react to what the market shows you.

The key lies in detaching yourself from speculation about what might or should be and focusing on what is actually happening. This approach gives you a significant advantage because you base your trading decisions on real data and trends, not on guesses or hopes.

Another central aspect of trend following is accepting the inherent risks of the market. Prices can rise, fall, or move sideways. Each of these movements offers both opportunities and risks. Losses are an inevitable part of trading, but through disciplined application of trend-following strategies, these risks can be contained and controlled.

Ultimately, trend following reminds us that trading is only about the here and now. The past has already happened, and the future is yet to be written. The current trend provides the best guidance for trading decisions. By following the trend instead of trading against it, you position yourself to profit from the market’s movements, no matter which direction they go.

These principles of trend following are not just strategies for financial success but also life lessons. They teach us to deal with uncertainty, remain flexible, and accept and utilize the reality of the moment. By internalizing and applying these essential truths, you lay the foundation for long-term success in trading.

My DowHow Strategy

Based on the principles of trend following developed by Charles Dow that you have already learned, I have also developed my DowHow Strategy. This results in the following rules for my strategy.

Rule 1: Our rule set requires a valid trend as the first prerequisite. When is such a valid trend present?

We need a movement, a correction, and another movement. If we have a valid trend, we are already in the second trend arm.

Rule 2: If our first rule is fulfilled, we ideally enter in the second trend arm, but at the latest in the fourth trend arm. Here, the probability of a trend continuation is 71.82%.

Rule 3: The correction of the trend must have run at least 38.2% in the second trend arm. You can easily measure this correction with a Fibonacci tool in your chart.

Rule 4: Finally, we need a strong reversal signal to complete our rule set.

I must emphasize that I generally work only with Heiken Ashi candles.

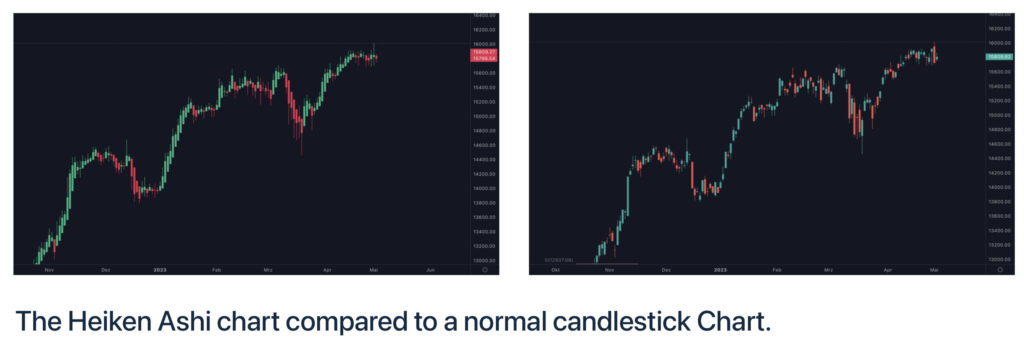

Trading with Heiken Ashi candles offers a great alternative to traditional candlestick charts and is a valuable tool for traders who want to recognize trends more easily and trade accordingly. Although a Heiken Ashi chart visually resembles a classic candlestick chart, its true value lies in the differences that may not be immediately apparent.

The central difference between a Heiken Ashi chart and a traditional candlestick chart is in the calculation and presentation of the candles. While a traditional candlestick chart shows the actual opening, high, low, and closing prices of a trading day, the Heiken Ashi chart uses an average price calculation.

A Heiken Ashi candle consists of six values and is based on average prices, leading to a smoothing of price movements and reducing visual “market noise.”

This smoothing of price movements is particularly advantageous for identifying clear trends. By reducing market fluctuations, trends and their continuations or potential reversals become more visible on the Heiken Ashi chart. This makes it easier for traders to make strategic decisions without being distracted by short-term price fluctuations.

A key element in trading with Heiken Ashi candles is the reversal signal, indicated by a so-called equilibrium candle (seen below between the 1.0 and 0.78 lines).

This special candlestick formation is characterized by a very thin candle body and long wicks both above and below. The equilibrium candle signals a potential change in market dynamics and can be interpreted as an indicator of the end of an existing trend or the beginning of a new trend.

Additionally, this is our reversal signal in Rule 4.

Now It’s Your Turn: Your Homework

Today we get down to the nitty-gritty in our trading challenge. I want you to engage intensively with my rule set today. Take the time to carefully go through the four rules. Here are your tasks for today.

If you haven’t fully mastered trend drawing yet, I recommend again using an indicator in TradingView. This step is to provide you with visual support to better assess whether there is currently a trend and in which direction it is moving.

How to activate the indicator can be found in the last post.

Assignment:

Switch your chart to Heiken Ashi: Start by switching your chart to Heiken Ashi. This will help you smooth price movements and recognize trends more clearly.

Identify the trend: Use the tool from yesterday or any other method available to you to identify the current trend in the chart.

Find the entry point in the second to fourth trend arm: Once you have identified the trend, look for an entry point within the second to fourth trend arm. This increases the likelihood that you are in a stable section of the trend and not entering at the end of a dying trend.

Use the Fibonacci tool: Open the Fibonacci tool that you see at the top of the chart and check if the correction is at least 38.2%. This is an important step to assess the strength of the correction within the trend.

Look for a reversal signal: Watch for a reversal signal that could indicate the beginning of a new trend arm or the continuation of the existing trend.

Simulate the trade (optional): If you have a demo account, take the opportunity to simulate the trade based on your analysis. This gives you a chance to see if you applied the rules correctly and how the trade could potentially unfold.

Have fun with today’s homework. We’ll see you tomorrow for the fourth day of our challenge.

Until tomorrow

Markus