Today you will learn why the stop loss is an indispensable safeguard for your trading.

Hello,

I am glad you are with us again today. We have now reached the fourth day of the Trading Challenge. Today, everything revolves around the topic of the stop loss.

Anyone who has delved deeply into trading will inevitably come across an essential instrument that is as controversial as it is fundamental: the stop loss.

But what exactly is a stop loss, and what role does it play in trading?

A stop loss is essentially a predefined limit that traders set to limit potential losses. The idea behind it is simple, but its implementation is as diverse as the markets themselves.

There are countless opinions about the usefulness and application of a stop loss, as varied as the sun and the moon. Some traders set their stops very tight and constantly adjust them, while others claim they don’t need stops or rely on completely different money management strategies.

Discussions about the pros and cons of a stop loss are as old as trading itself. But one thing is undeniable: a well-placed stop loss can be the lifeline in turbulent market phases, protecting you from emotional decisions.

Today, we will delve deeply into the topic of stop loss. We will look at why a stop loss is an indispensable tool for many traders, the different approaches that exist, and how you can use the appropriate stop loss for different situations.

Why the stop loss protects your trading idea, not just your capital

While many view the stop loss as a necessary evil, a closer look reveals its true function, which goes far beyond mere loss limitation. The stop loss is not just an instrument to protect your capital – it serves to protect your trading idea.

Have you ever considered this perspective?

The distinction between protecting your trading idea and protecting your capital is subtle but crucial. As a trend trader, I place the stop loss directly below my entry point. If the price falls below our stop value, the valid trend up to that point is broken. In this case, the stop is triggered by the price falling below the level, ending our trade.

After that, the initial trend, and especially our trading idea, no longer exists.

Although the stop loss is primarily used to protect capital, as it exposes your account to only limited risk – the amount you have set for each trade – its true value lies in safeguarding our trading idea. Our trading idea, which is valid only if all four rules are met, ends when the stop loss order is triggered.

Many traders, especially in the early stages, tend to ignore the negative developments of a trade and move the stop loss further away from the originally set price level, hoping the market will turn in the desired direction. This behavior can quickly lead to significant losses or, in the worst case, a total crash.

The key to successful trading with stop loss orders is to set them precisely beforehand and only move the stop loss in the direction of profit. This requires discipline and an understanding that the stop loss is not just a means to limit financial losses, but rather a strategic tool that secures your trading idea.

Use the stop loss as an integral part of your trading strategy, allowing you to trade objectively and unaffected by emotions.

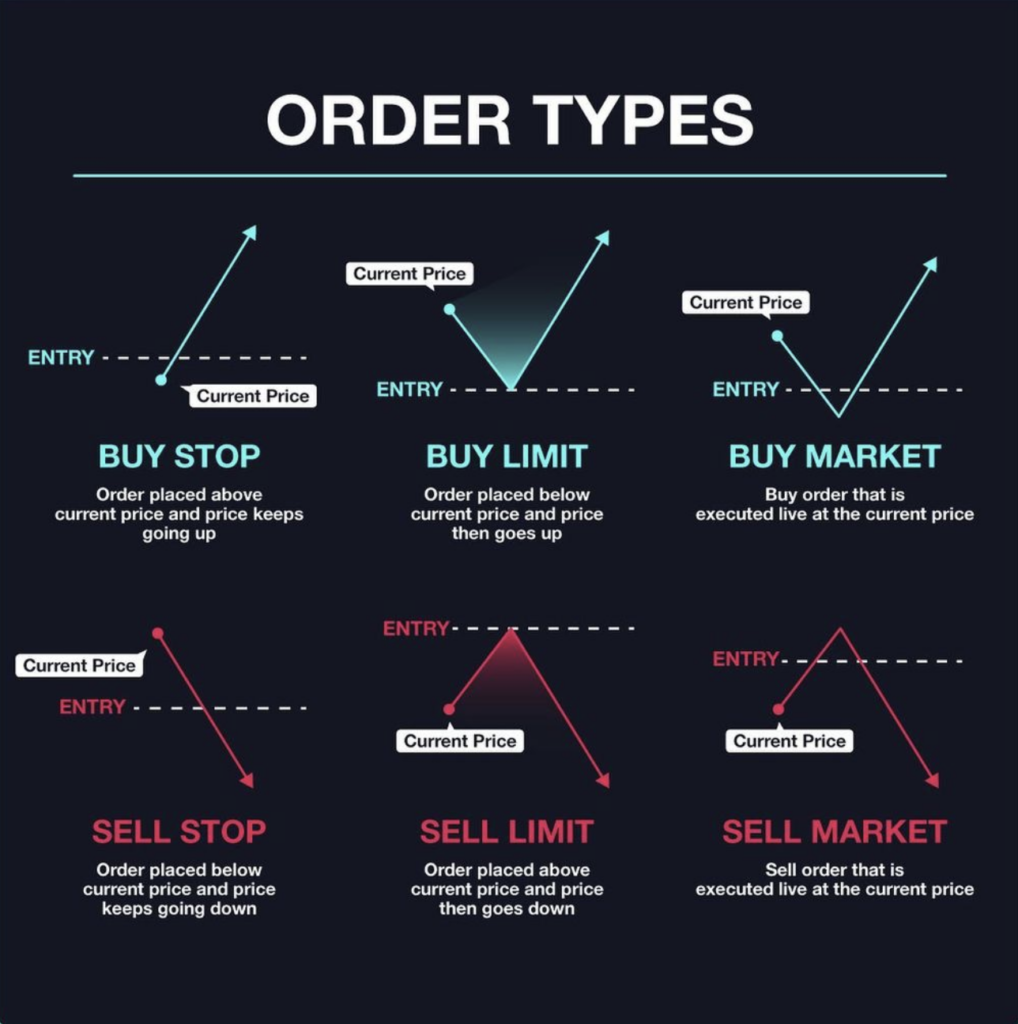

Different types of trading orders

In trading, there are various types of orders, each pursuing different strategies and goals. Here are the three types of orders explained:

Market Order: a market order is an instruction to buy or sell a stock at the current best possible market price. While a market order typically guarantees the execution of the trade, it does not guarantee a specific price. Market orders are optimal when the main goal is to execute the trade immediately.

They are particularly suitable if you believe a stock is correctly valued at the current price, if you desire guaranteed order execution, or if you aim for immediate execution. But beware! In case of extremely high demand, you might get a very bad market price, which can lead to significant losses if the market turns shortly afterward.

Limit Order: a limit order is an instruction to trade a stock at a specific maximum price (for a buy) or minimum price (for a sell). If the order is executed, it will only be at the set limit price or better. However, there is no guarantee of execution. A limit order is useful if you believe you can buy at a lower price or sell at a higher price than the current market price.

Stop Order: a stop order is an instruction to buy or sell a stock at the market price once the stock reaches or exceeds a certain price (the “stop price”). When the stock hits the stop price, the order becomes a market order and is executed at the next possible market price. If the stock does not reach the stop price, the order is not executed.

Each of these order types offers specific advantages and can be used effectively depending on the market situation and personal trading strategy. While market orders are designed for quick execution, limit and stop orders provide more control over the price but carry the risk of the order not being executed.

Choosing the right order type is a crucial part of successful trading and should always be carefully considered.

Advantages of a Stop Loss

For me, using a stop loss is far more than just an advantage; it is an indispensable necessity in trading. This necessity brings a certain peace and clarity to your trading.

From the outset, you know exactly how much money you are risking and potentially losing if your setup does not bring the expected success. This is simply because the market occasionally decides differently.

A stop loss helps you as a trader to maintain an emotional distance from your trades. Instead of being driven by fear, greed, or hope, the stop loss enables an objective and disciplined approach. Once you have set the stop loss, you have made a decision that stands independent of emotions.

The automation of the trade exit through a stop loss order frees you from the constant need to monitor the market. This freedom allows you to focus your energy on analyzing new trading opportunities. You can plan strategically while being confident that your positions are always secured in case the market turns unexpectedly.

This provides you with the greatest possible peace you can have in trading. Once your trade is set, you have done your job completely. You no longer have any influence on the market. Your only task then is to manage your trade and, at best, watch your capital grow.

The question of how much space a stop loss should have is essential for risk and money management in trading. The answer largely depends on your individual trading approach and strategy.

As a trend trader, you place the stop loss for short positions directly above the last correction point. Conversely, the stop for long positions is set directly below the last correction point. This approach aims to protect you from larger losses if the market moves against your position.

Regardless of your specific trading approach, one overarching principle always takes precedence: risk and money management.

Trailing Stop vs. Soft Stop

Is there a difference between a trailing stop and a stop loss? At first glance, it may seem like both terms describe the same concept – after all, a stop is a stop. However, on closer examination, we differentiate between an initial stop and a soft stop, also called a mental stop.

In practice, you usually work with an initial stop, which is also known to your broker. This type of stop is characterized by being anchored at a predetermined price level and remaining static.

The soft stop, on the other hand, exists either only in your mind or is controlled by advanced trading software, such as the AgenaTrader.

The key difference comes into play when we look at the trailing stop. A trailing stop offers the special function of automatic adjustment. This means the trailing stop automatically follows your trade, adjusting as the setup develops accordingly. This dynamic adjustability allows you to secure potential gains because the stop loss is automatically moved in the direction of positive price movement.

Thus, while an initial stop sets a firm limit to contain losses, the trailing stop also offers the ability to let profits run while simultaneously securing these gains. The trailing stop is therefore a valuable addition to your trading strategy, providing not only protection against losses, but also helping to maximize profit potential.

The decision on which type of stop best suits your individual trading strategy depends on your goals, risk management, and personal preference.

Now It’s Your Turn: Your Homework

We have now covered various aspects of trading, especially the importance of stop loss, trailing stop, and other order types. Each of these order types plays a crucial role in a trader’s risk management and execution strategy. Understanding when and how each order type is used effectively is a fundamental building block for success in trading.

Assignment:

Your task for today is to internalize the different order types and understand in which specific situations they are best applied.

The stop loss is a very important tool that you should master. Therefore, I advise you today to specifically revisit the different orders and the stop loss to ensure you know exactly when to use which type of order.

Have fun with today’s homework. We will see you tomorrow for the fifth day of our challenge.

See you tomorrow

Markus